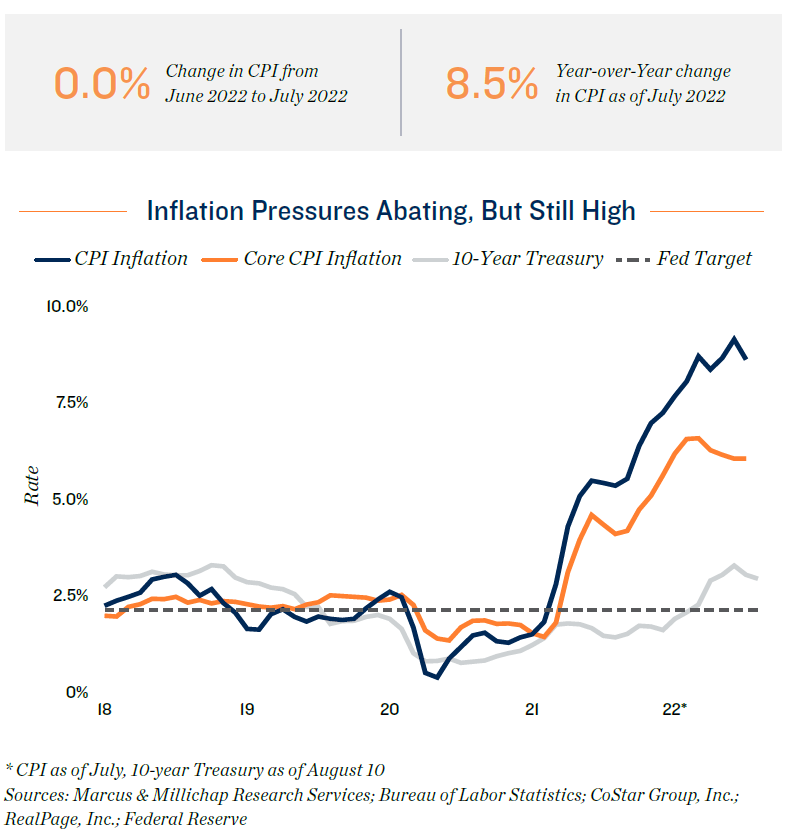

The headline Consumer Price Index in July was up 8.5 percent compared to a year prior, a deceleration from the 9.1 percent year-over-year jump recorded in June. This slowdown was driven predominantly by a month-overmonth decline in energy prices, led by a 7.7 percent drop in the gas price component of the index. The costs of other items, most notably food, continued to rise however. Setting aside energy and food, core CPI advanced 5.9 percent year-over-year in July, matching the pace set in June but below the 6.4 percent year-over-year increase reported in March. Stability in the core index paired with a smaller rise in the headline rate suggest that inflation may have peaked, likely a reflection of less impeded supply chains and tightening monetary policy.

Supply chains factor into inflation, industrial space demand.

While the collective 225-basis-point increase in the federal funds rate so far this year is weighing on borrowing activity, it is not the only factor contributing to decelerating inflation. Supply chains are also showing improvement. The transit time between shipping goods from China to the U.S. has declined from a pandemic peak of 83 days to 63. While still

above the pre-2020 norm of 48 days, this shift is nevertheless helping supply better meet demand, softening upward pricing pressure. Adapting to these challenges has translated into a robust uptake in industrial space. Absorption has been elevated since mid-2021, driving the national vacancy rate down 120 basis points year-over-year in

June to 3.7 percent, its lowest level since at least 2000. Record construction should help stabilize availability this year, with competition by tenants propelling asking rents up by double-digit percentages.

Additional quantitative tightening still on the docket.

While slowing, inflation is still high, which will likely prompt the Federal Reserve to raise the overnight lending rate again in September. Next month the Fed will also double its level of balance sheet reductions to $95 billion in monthly volume. Long-term interest rates, such as the 10-year Treasury, will likely feel upward pressure as a result. The combination of elevated inflation and climbing interest rates will be a challenge for investors, however, the market has already begun to recalibrate. In some cases, prices are being adjusted or buyers are reducing leverage. Investors may also be considering new locations or asset types. Overall, the market is liquid, with investors holding favorable long-term outlooks. Multifamily outlook largely unfazed. The impact of high inflation and rising interest rates is so far not having a substantial impact on the underlying need for housing. Demand for apartments surged in 2021, with net absorption eclipsing 650,000 units, nearly double the previous peak. That metric has been more tempered in the first half of 2022, due in part to delayed eviction proceedings, as well as limited options for prospective tenants. June’s 3.2 percent national vacancy rate was a three-decade-plus low for that time of year. Tight availability aids rent growth in the near-term, while a structural housing shortage also lends strength to the outlook for the next three to seven years. Lower fuel costs boost hospitality outlook for rest of year. The energy component of CPI, which was up 43.5 percent year-over-year in June, took a notable step down last month, with prices falling across oil, gasoline and natural gas. This shift bodes especially well for travel. Hotels have already seen increased bookings throughout the year, despite higher fuel costs. June occupancy was just above 70 percent, a pandemic-era first, even with an average daily room rate more than 15 percent above the same point in 2019, that helped compensate for higher costs. The ability to reprice rooms on a daily basis can also appeal to investors concerned about short-term cash flow during elevated inflation.

Additional CRE Trends:

Multifamily outlook largely unfazed.

The impact of high inflation and rising interest rates is so far not having a substantial impact on the underlying need for housing. Demand for apartments surged in 2021, with net absorption eclipsing 650,000 units, nearly double the previous peak. That metric has been more tempered in the first half of 2022, due in part to delayed eviction proceedings, as well as limited options for prospective tenants. June’s 3.2 percent national vacancy rate was a three-decade-plus low for that time of year. Tight availability aids rent growth in the near-term, while a structural housing shortage also lends strength to the outlook for the next three to seven years.

Lower fuel costs boost hospitality outlook for rest of year.

The energy component of CPI, which was up 43.5 percent year-over-year in June, took a notable step down last month, with prices falling across oil, gasoline and natural gas. This shift bodes especially well for travel. Ho-tels have already seen increased bookings throughout the year, despite higher fuel costs. June occupancy was just above 70 percent, a pandem-ic-era first, even with an average daily room rate more than 15 percent above the same point in 2019, that helped compensate for higher costs. The ability to reprice rooms on a daily basis can also appeal to investors concerned about short-term cash flow during elevated inflation.